New to CFD trading?

CFDs

Trade globally with SebaFX

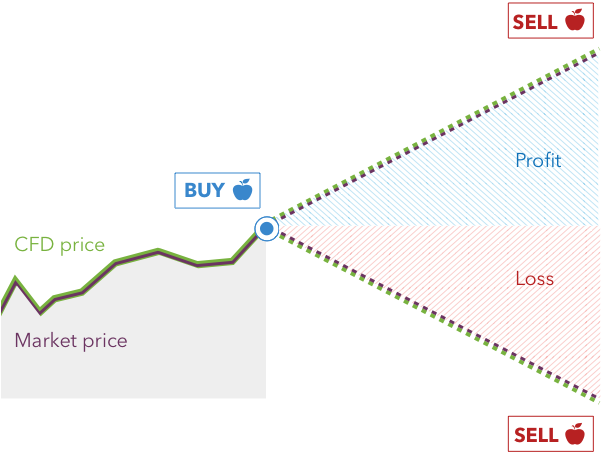

Instead, when you trade a CFD, you are agreeing to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed. One of the main benefits of CFD trading is that you can speculate on price movements in either direction, with the profit or loss you make dependent on the extent to which your forecast is correct.

The sections that follow explain some of the main features and uses of contracts for difference:

1.Short and long trading

2.Leverage

3.Margin

4.Hedging

Short and long CFD trading explained

If you think Apple shares are going to fall in price, for example, you could sell a share CFD on the company. You’ll still exchange the difference in price between when your position is opened and when it is closed, but will earn a profit if the shares drop in price and a loss if they increase in price.

With both long and short trades, profits and losses will be realised once the position is closed.

Leverage in CFD trading explained

While leverage enables you to spread your capital further, it is important to keep in mind that your profit or loss will still be calculated on the full size of your position. In our example, that would be the difference in the price of 500 Apple shares from the point you opened the trade to the point you closed it. That means both profits and losses can be hugely magnified compared to your outlay, and that losses can exceed deposits. For this reason, it is important to pay attention to the leverage ratio and make sure that you are trading within your means.

Margin explained

When trading CFDs, there are two types of margin. A deposit margin is required to open a position, while a maintenance margin may be required if your trade gets close to incurring losses that the deposit margin – and any additional funds in your account – will not cover. If this happens, you may get a margin call from your provider asking you to top up the funds in your account. If you don’t add sufficient funds, the position may be closed and any losses incurred will be realised.

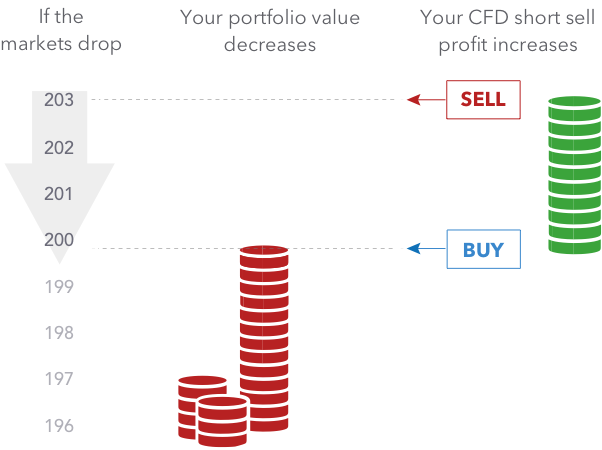

Hedging with CFDs explained

For example, if you believed that some ABC Limited shares in your portfolio could suffer a short-term dip in value as a result of a disappointing earnings report, you could offset some of the potential loss by going short on the market through a CFD trade. If you did decide to hedge your risk in this way, any drop in the value of the ABC Limited shares in your portfolio would be offset by a gain in your short CFD trade.

Why trade with SebaFX?

- Direct Market Access (DMA)

- Leverage up to 1:500

- T+0 settlement

- Dividends paid in cash

- Free from Stamp Duty

- Short selling available

- Commissions from 0.08%

- Access to 1500 global shares

Check out our Shares offer

| NAME | INITIAL DEPOSIT |

|---|---|

| Apple Inc CFD | 10% |

| Alibaba CFD | 10% |

| Facebook CFD | 10% |

Trade -globally with SebaFX

Get ultra-competitive spreads and commissions across all asset classes. Receive even better rates as your volume increases.

Register

Fill in your personal details in our secure online application.

Deposit

Make a deposit via debit card, wire transfer, eCheck or check.

Trading

Once your approved, you can trade on desktop and mobile.